In the dynamic world of construction, securing the right financing is crucial for turning visions into reality. Understanding construction loan rates can be a daunting task, yet it’s vital for planning your next project effectively. This article aims to demystify construction loan rates, providing insights into their fundamental principles and the various factors that influence them.

We will guide you through the process of calculating accurate projections for your financing needs, while sharing invaluable tips for securing the best rates available. Additionally, we’ll present a comprehensive comparison guide to help you make informed decisions.

Whether you’re a seasoned builder or embarking on your first project, gaining clarity on construction loan rates will empower you to navigate through the financial landscape with confidence. Let’s get started on making your construction dream a reality!

Exploring The Basics Of Understanding Construction Loan Rates

When embarking on a construction project, one of the critical aspects you must grasp is the concept of understanding construction loan rates. These rates dictate the overall cost of borrowing funds for your project and can significantly influence your budget and financing decisions.

Construction loans are typically short-term loans designed to cover the costs of building a home or a commercial property. Unlike traditional mortgages, which are issued for the purchase of an existing property, construction loans are released in phases called draws to fund different stages of the construction process. This makes it essential to have a clear understanding of how the rates for these loans work.

Understanding construction loan rates requires familiarity with several key components:

- Fixed vs. Variable Rates: Construction loans can come with either fixed or variable interest rates. A fixed-rate loan maintains the same interest rate throughout the loan term, while a variable-rate loan may fluctuate based on market conditions.

- Loan-to-Value Ratio (LTV): LTV is a ratio that compares the loan amount to the appraised value of the property. A lower LTV can often result in more favorable interest rates.

- Credit Score: Your credit score plays a significant role in determining your interest rate. Higher credit scores typically yield lower rates, as they are associated with lower risk for lenders.

- Your Builder’s Credentials: Lenders assess the qualifications and experience of the builder. A reputable builder can positively impact rates and loan approval.

By understanding these basic principles of construction loan rates, you can make informed decisions that will ultimately affect both your project’s success and your financial health. Being well-informed allows you to approach lenders with confidence and negotiate terms that best serve your needs.

Factors Influencing Construction Loan Rates And Their Impact

When embarking on a construction project, understanding the various factors that influence construction loan rates is crucial for budgeting and financial planning. Several elements come into play that can significantly affect the rates you are offered. Below are some key factors to consider:

- Credit Score: One of the most influential factors is your credit score. Lenders assess your creditworthiness to determine the risk involved in lending you money. A higher credit score typically translates to lower interest rates.

- Loan Amount: The amount you plan to borrow also impacts your loan rates. Larger loans often come with higher interest rates due to increased risk for the lender.

- Loan-to-Value Ratio (LTV): The LTV ratio, which compares the loan amount to the appraised value of the property, plays a crucial role. A lower LTV indicates less risk for the lender, often resulting in more favorable rates.

- Construction Type: The type of construction project (residential, commercial, or renovation) can influence rates, as some projects carry more risk than others due to factors like market demand and location.

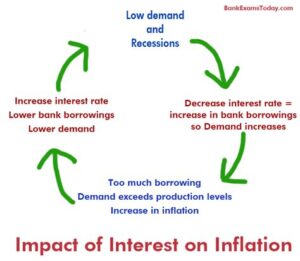

- Market Conditions: Economic factors such as interest rates, inflation, and local real estate market conditions can change frequently, influencing loan rates. Keeping an eye on the market is essential for borrowers looking to secure the best deals.

- Down Payment: A significant down payment can lower your loan rates. Lenders see a substantial investment from you as a sign of commitment and lower risk, which can lead to more favorable terms.

- Lender Policies: Each lender has its own policies and risk criteria, which can lead to variations in construction loan rates. It’s advisable to shop around and compare offers from multiple lenders.

Understanding these factors will empower you to make informed decisions when planning your project. Keep in mind that proactive preparation and a clear strategy can significantly impact the overall cost, making the case for diligent financial assessment in every step of the building process.

Calculating Your Construction Loan Rates For Accurate Projections

Calculating your construction loan rates accurately is crucial for any project, as it allows you to effectively budget and plan for expenses. Here’s a breakdown of the key steps involved in calculating your construction loan rates:

1. Understand the Loan Structure: Construction loans typically come in two stages: a short-term phase during the construction period and a long-term phase upon completion. Understanding this structure will help you in recognizing how rates are determined at each stage.

2. Calculate Your Loan Amount: Determine the total amount you need to borrow, which includes land acquisition, construction costs, permits, and any potential overruns. This total will directly impact your rate calculations.

3. Review Current Interest Rates: Investigate the current market rates for construction loans. Rates can vary significantly based on the lender, your credit score, and the overall market conditions.

4. Factor in Additional Costs: Don’t forget to include origination fees, inspection fees, and any other related costs in your financial projections. These can impact the overall affordability of your project.

5. Utilize a Construction Loan Calculator: Online calculators can help you input your loan amount, term, and interest rate to produce an estimation of monthly payments and total interest paid over the life of the loan.

6. Compare Offers: Once you have a clear estimate, compare multiple lenders and their rates. Ask for quotes that detail all costs associated with each loan to find the most favorable terms.

By carefully following these steps, you can achieve a clear understanding of your construction loan rates, ensuring that your budget aligns with your project’s financial goals. Properly understanding construction loan calculations will ultimately set the foundation for a successful building project.

Tips For Securing The Best Understanding Construction Loan Rates

Securing the best rates for your construction loan can significantly impact your overall project finances. Here are some effective tips to help you achieve favorable Understanding Construction loan rates:

- Improve Your Credit Score: Lenders prioritize borrowers with higher credit scores. Ensure your credit history is clean by paying off debts and avoiding new credit inquiries before applying for a loan.

- Shop Around: Don’t settle for the first loan offer. Compare rates and terms from multiple lenders to find the best deal that suits your financial needs.

- Consider Different Loan Types: Explore various construction loan options. Fixed-rate loans may offer more stability, while adjustable-rate loans might provide lower initial rates.

- Provide a Larger Down Payment: A significant down payment can lower your loan amount and reduce the lender’s risk, which can lead to better interest rates.

- Prepare a Comprehensive Project Plan: Present a clear and detailed project plan to your lender. This demonstrates your professionalism and reduces perceived risks, potentially leading to better rates.

- Make Timely Payments on Existing Loans: A good payment history on any current loans or mortgages can build your credibility with lenders and enhance your negotiating position.

- Consider a Co-Signer: If your creditworthiness isn’t strong enough, having a co-signer with better credit can help you secure a better rate.

By following these tips, you can enhance your chances of finding the most advantageous Understanding Construction loan rates, ensuring that your project is financed efficiently and cost-effectively.

Understanding Construction Loan Rates: A Comprehensive Comparison Guide

When evaluating different financing options for your project, it’s crucial to have a solid grasp on Understanding Construction loan rates. This section provides a comprehensive comparison of various aspects of construction loan rates to help you make informed decisions.

Construction loan rates can vary greatly among lenders, and understanding these differences will enable you to choose the most suitable option for your needs. Below is a comparison of key elements that affect construction loan rates:

| Factor | Description | Impact on Rates |

|---|---|---|

| Loan Type | Fixed-rate vs. variable-rate loans | Fixed-rate loans often have higher initial rates but provide stability over time, while variable rates can start lower but may fluctuate. |

| Credit Score | Your personal credit score, which lenders use to assess risk | Higher credit scores typically result in lower interest rates, while lower scores may lead to higher rates. |

| Loan-to-Value Ratio (LTV) | The ratio of the loan amount to the appraised value of the property | A lower LTV ratio can indicate less risk to the lender, potentially leading to reduced rates. |

| Location | The geographical area where the construction will take place | Rates can vary by location due to local market conditions and regulations. |

| Loan Term | The duration of the loan | Shorter loan terms may offer lower overall rates compared to longer terms. |

Additionally, it’s advisable to compare rates from multiple lenders. A good practice is to obtain at least three to five quotes and evaluate them carefully to find the best deal available in the market. Remember to factor in the total cost of borrowing, including fees and closing costs, which may influence the overall affordability of the loan.

Keeping these comparison points in mind will help you navigate the complex world of construction financing with more confidence and clarity, ultimately contributing to the success of your construction project.

Frequently Asked Questions

What are construction loan rates?

Construction loan rates are the interest rates charged by lenders on loans used specifically for financing the building or renovation of a property.

How do construction loan rates differ from traditional mortgage rates?

Construction loan rates are usually higher than traditional mortgage rates due to the increased risk involved for lenders, as they are funding a project that may or may not be completed.

What factors affect construction loan rates?

Factors that affect construction loan rates include the borrower’s credit score, the loan amount, the length of the loan, the lender’s policies, and the overall economic conditions.

Are construction loan rates fixed or variable?

Construction loan rates can be either fixed or variable, but many lenders offer adjustable-rate options that may change after a specific period.

What steps can I take to secure a better construction loan rate?

To secure a better construction loan rate, you can improve your credit score, shop around for different lenders, and consider making a larger down payment.

What is the typical process for obtaining a construction loan?

The typical process involves applying for the loan, providing necessary documentation, having the project plans reviewed, and then undergoing an appraisal to determine the property’s value.

Can I refinance my construction loan once the project is completed?

Yes, many borrowers choose to refinance their construction loan into a permanent mortgage after the project is completed to take advantage of potentially lower rates.

Leave a Reply