Navigating the world of construction financing can be challenging, especially when it comes to understanding interest rates. As a crucial factor that influences your construction budget, fluctuations in interest rates can significantly impact the overall cost of your project.

In this article, we will demystify the complexities surrounding interest rates in construction loans, exploring the fundamental concepts and key factors that contribute to these changes. By understanding how interest rates work, you can make informed decisions that will help you secure the best financing options.

Additionally, we’ll share practical tips for locking in favorable rates and discuss the long-term implications of interest rate variations on your construction endeavors. Whether you’re a seasoned builder or embarking on your first project, our insights will empower you to manage your construction finances effectively.

The Basics of Understanding Interest Rates in Construction Loans

When embarking on a construction project, one of the most critical aspects to consider is the cost of financing, particularly the understanding interest rates applicable to construction loans. Interest rates directly impact your overall budget and the feasibility of your project. Here are some fundamental concepts to grasp when navigating this terrain:

1. Definition of Interest Rates: Interest rates are the charges that lenders impose for borrowing funds. In construction loans, these rates can vary significantly based on several factors, including the type of loan, the lender, and broader economic conditions.

2. Fixed vs. Variable Rates: Construction loans can come with either fixed or variable interest rates. Fixed rates remain constant throughout the loan’s term, providing predictable repayment amounts. In contrast, variable rates can fluctuate over time, often in response to changes in the market or the economy.

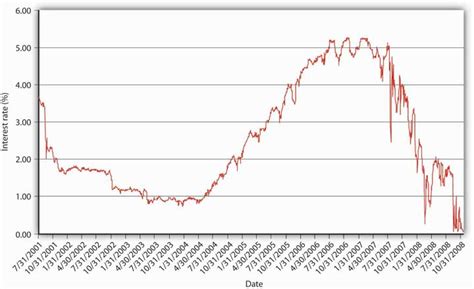

3. Impact of Economic Indicators: Interest rates in construction loans are influenced by economic indicators like inflation, employment rates, and economic growth. Monitoring these can help you anticipate potential rate changes and their effect on your project financing.

4. Loan Types and Their Rates: Different types of loans—such as conventional loans, FHA loans, or VA loans—often come with varying interest rates based on associated risks and benefits. Understanding your options is crucial for securing favorable financing.

5. Timing and Rate Locks: Timing can play a significant role in the interest rates you experience. Many lenders allow borrowers to lock in rates for a certain period, providing protection against potential rate increases during the loan approval process. Knowing when and how to lock in rates can enhance your financial strategy.

Having a solid grasp on the basics of interest rates in construction loans will empower you to make informed financial decisions throughout your project. It can aid in managing costs effectively and ensure that your construction budget remains intact despite fluctuations in the interest market.

Factors Influencing Interest Rate Fluctuations in Construction Financing

Understanding interest rates in the context of construction loans is pivotal for both builders and borrowers. Several key factors can cause fluctuations in interest rates and impact your overall financing costs:

- Economic Conditions: The broader economic environment plays a significant role in determining interest rates. When the economy is booming, demand for loans increases, which can push rates higher. Conversely, during economic downturns, rates may decrease to stimulate borrowing.

- Inflation Rates: Higher inflation often leads to increased interest rates. Lenders require higher rates to maintain their profit margins and offset the decreasing purchasing power of money.

- Federal Reserve Policies: The actions of the Federal Reserve, particularly changes in the federal funds rate, can influence interest rates across various types of loans. When the Fed raises rates, it typically results in higher borrowing costs in the construction sector.

- Market Competition: The level of competition among lenders can lead to fluctuations in interest rates. More lenders in the market often results in more favorable rates for borrowers as lenders compete for business.

- Construction Sector Performance: The health of the construction industry itself can affect interest rates. If the sector is experiencing growth, lenders may increase rates to capitalize on the demand.

- Loan Duration: The term length of the loan can also influence interest rates. Generally, longer-term loans come with higher rates due to the increased risk over time.

- Borrower Profile: Lenders assess the risk profile of borrowers, including credit history and financial stability. Higher-risk profiles can lead to higher interest rates.

- Supply of Construction Funding: Changes in the availability of funding sources for construction can influence rates. A shortage of investors or funding can lead to higher rates.

- Geopolitical Events: Global events such as political instability or trade tensions can create uncertainty in the financial markets, potentially leading to fluctuations in interest rates.

- Regulatory Changes: New regulations regarding lending practices can impact how lenders operate and potentially affect the interest rates offered on construction loans.

By understanding interest rate influences, borrowers can better navigate the complexities of construction financing and make informed financial decisions that align with their project goals.

How Understanding Interest Rates Affects Your Construction Budget

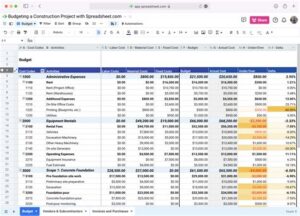

Understanding interest rates is crucial for effective financial planning in any construction project. A significant aspect of Understanding Interest revolves around how these rates can directly influence your overall budget and cash flow. Here’s how:

The cost of borrowing funds through construction loans primarily hinges on the prevailing interest rates. When rates are high, the interest you need to pay on borrowed amounts increases, adding a considerable burden to your budget. Conversely, lower interest rates mean cheaper loan repayments, freeing up funds for other essential aspects of your project.

Additionally, fluctuating interest rates can affect the total duration of your financing. If you lock in a higher rate at the beginning and the rates subsequently drop, you might find yourself short on funds, resulting in a budget deficit or the need to adjust your initial plans. This unpredictability underlines the importance of keeping a close eye on market trends.

Moreover, understanding interest rates can help you make informed decisions regarding your timeline. For instance, if you’re aware that rates are set to rise, you might choose to expedite certain phases of your project to secure financing at current rates sooner rather than later.

You can also negotiate better terms with lenders if you have a solid grasp of interest rates. Showing awareness of market conditions demonstrates your preparedness and can lead to more favorable loan conditions, further strengthening your construction budget.

Comprehending Understanding Interest rates and their implications is not just a financial necessity; it is a strategic advantage that ensures the viability and success of your construction project.

Tips for Locking in the Best Interest Rates for Construction Loans

Locking in the best interest rates for construction loans is crucial for ensuring your project’s financial viability. Here are some effective strategies to consider:

- Start Early: Begin your research on interest rates and potential lenders well ahead of your project initiation. This preparation allows you to notice trends and identify favorable lending environments.

- Monitor Market Trends: Keeping an eye on economic indicators and overall market conditions will help you anticipate when interest rates may rise or fall, enabling you to take advantage of a dip.

- Build a Strong Credit Profile: Lenders are more likely to offer competitive rates to borrowers with excellent credit scores. Take steps to improve your credit ahead of applying for your construction loan.

- Consider Different Loan Types: Explore various loan products such as fixed-rate versus variable-rate loans. A fixed-rate loan might provide more stability, while a variable-rate loan may offer lower initial rates.

- Negotiate with Lenders: Don’t hesitate to negotiate the offered interest rates. Having multiple offers can enhance your position during negotiations.

- Stay Informed about Rate Locks: Some lenders offer a rate lock option, where you can secure the current interest rate for a specific period. Understand the terms and conditions of such locks and use them strategically.

- Work with a Mortgage Broker: A broker can provide access to a broader range of lenders and loan products, increasing your chances of securing a favorable rate.

- Prepare a Comprehensive Loan Application: Providing all required documentation early and accurately can streamline the loan approval process and help you lock in rates faster.

- Evaluate Points and Fees: Sometimes lower interest rates come with higher points or fees. Assess the total cost of the loan over its lifetime to make an informed decision.

By employing these strategies, you can improve your chances of securing a competitive interest rate while understanding interest rate fluctuations, ultimately benefiting your construction budget and project success.

The Long-Term Impact of Interest Rate Changes on Your Construction Project

Understanding interest rates is crucial for any construction financing strategy, as even minor fluctuations can have a significant long-term impact on your overall project costs. When securing a construction loan, the interest rate you lock in at the start will dictate how much interest you pay over the life of the loan.

Firstly, it’s essential to recognize that if interest rates rise after you secure your financing, the value of your project may be affected. Higher rates can lead to increased borrowing costs for future projects, reducing the overall demand in the construction market. This scenario may also affect your project’s resale value, should you decide to sell it in the future.

On the other hand, if you locked in a lower interest rate before rates increased, you may benefit from lower monthly payments, making your project more financially viable. Long-term financial stability is critical, so understanding interest rate trends and securing favorable terms can significantly affect your project’s success.

Additionally, changes in interest rates can influence the availability of financing. Lenders may tighten their eligibility requirements during periods of rising rates, making it more challenging for builders to secure necessary funds, which can delay or hinder project completion.

understanding interest rate fluctuations is paramount for any construction project. Staying informed about economic indicators and trends can assist you in making strategic decisions that can mitigate potential negative impacts on your project’s budget and timeline.

Frequently Asked Questions

What are construction loans?

Construction loans are short-term, higher-interest loans used to finance the building or renovation of a home or commercial property.

Why do interest rates fluctuate on construction loans?

Interest rates on construction loans fluctuate based on market conditions, the Federal Reserve’s monetary policy, and the perceived risk by lenders.

How can fluctuations in interest rates affect construction projects?

Fluctuations in interest rates can impact the overall cost of financing for construction projects, potentially leading to higher monthly payments and affecting project budgets.

What factors influence interest rates on construction loans?

Factors include inflation, economic growth, the housing market’s condition, and changes in the Federal Reserve’s benchmark rates.

Are construction loans fixed or variable rate?

Construction loans can be either fixed-rate or variable-rate, with variable rates adjusting periodically based on market conditions.

How can borrowers protect themselves from rising interest rates?

Borrowers can consider locking in a fixed interest rate, choosing a shorter loan term, or discussing options with their lender to mitigate risks associated with interest rate increases.

What is the typical duration of a construction loan?

Construction loans typically have a duration of 6 months to 2 years, depending on the project’s scope and lender terms.

Leave a Reply