Securing a construction loan is a crucial step in turning your dream project into reality. However, the preparation process can be complex and daunting without the right guidance. In this article, we will walk you through the essential steps to prepare your finances effectively for a construction loan.

From understanding your credit score and creating a comprehensive budget to gathering necessary documentation, each aspect plays a vital role in successfully navigating the loan application process.

By determining the right loan amount and choosing the best lender for your specific needs, you can set yourself up for financial success. Join us as we delve into these key components and provide you with the knowledge you need to embark on your construction journey with confidence.

Understanding Your Credit Score For A Construction Loan

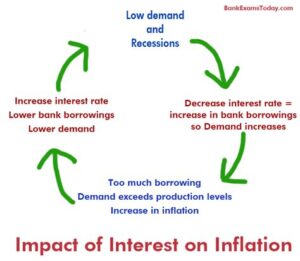

Your credit score plays a crucial role when it comes to securing a construction loan. Lenders use this score to assess your financial responsibility and determine your eligibility for a loan, as well as the interest rate you will receive. Understanding how your credit score affects your loan possibilities is essential for anyone considering how to prepare financially for a construction project.

A strong credit score typically ranges from 700 to 850, while a score below 600 may hinder your chances of loan approval. Therefore, it is advisable to check your credit score ahead of applying for a loan. Here are a few components of your credit score that you should focus on:

- Payment History: This is the most significant factor, accounting for about 35% of your score. Ensure that all your bills, including credit cards and loans, are paid on time.

- Credit Utilization: This measures how much of your available credit you are using. Ideally, you should keep this ratio below 30%.

- Length of Credit History: Lenders prefer borrowers with a long credit history as it gives them a sense of how you manage credit over time.

- Types of Credit: Having a mix of credit types, such as credit cards, a car loan, or a mortgage, can improve your score.

- Recent Inquiries: Minimize how often you apply for new credit. Each inquiry can have a slight negative impact on your score.

Before applying for a construction loan, it’s wise to review your credit report for any errors that might lower your score. You can dispute inaccuracies with the credit bureau to have them corrected. Additionally, consider strategies to improve your credit score, such as paying down existing debt or refraining from taking on new debt in the months leading up to your loan application.

By making informed decisions regarding your credit score, you will enhance your chances of getting approved for the construction loan you need. Understanding this crucial aspect of financing is paramount in the overall process of how to prepare your finances for a construction loan.

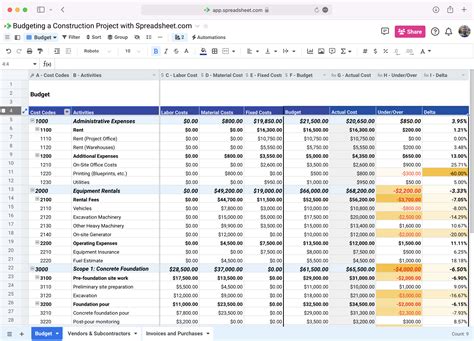

How To Create A Comprehensive Budget For Your Project

Creating a comprehensive budget is essential to ensure that your construction project stays on track financially. A well-structured budget will help you identify costs upfront and allocate resources efficiently. Here are the key steps on how to create a budget that covers all necessary aspects of your project:

- Research Costs: Begin by researching typical costs for the specific type of construction you are planning. This includes labor, materials, permits, and any additional expenses that may arise.

- List All Expenses: Create a detailed list of all potential expenses associated with the project. Categorize them into sections such as land acquisition, construction, landscaping, and interior finishes.

- Include Contingency Funds: It’s crucial to include a contingency fund, typically around 10-15% of the total project cost, to cover unforeseen expenses or changes in the project scope.

- Consider Financing Costs: Don’t forget to incorporate any interest or fees related to your construction loan into your budget.

- Outline a Timeline: Create a timeline for your project that aligns with your budget. This will help you track expenditures and ensure that spending is kept within budget at every stage.

- Regularly Review and Adjust: Once your project is underway, review your budget regularly. Track your spending against your budget to spot any discrepancies and adjust as needed.

By carefully taking each of these steps on how to create a comprehensive budget, you will set a solid financial plan in place for your construction project, ultimately leading to more successful outcomes.

Gathering Essential Documents To Secure A Construction Loan

Securing a construction loan requires careful preparation and a thorough understanding of the necessary documentation. The more organized your paperwork, the smoother the application process will be. Here’s a checklist of essential documents you need to gather:

- Proof of Income: This includes recent pay stubs, W-2 forms, or tax returns for the last two years. Self-employed individuals may need to provide profit and loss statements.

- Credit History: Lenders will conduct a credit check, so it’s essential to review your credit history in advance.

- Construction Plans: Detailed blueprints and specifications of your project, along with any necessary permits and approvals.

- Builder’s Information: Provide details about your chosen contractor, including their license and insurance information, and any previous work they’ve completed.

- Bids or Estimates: Include bids or estimates from contractors to show the estimated cost of construction.

- Land Documentation: Proof of ownership or a purchase agreement for the land where the construction will take place.

- Project Timeline: Outline the expected construction timeline, detailing project milestones.

- Personal Identification: Valid identification, such as a driver’s license or passport, may also be required.

By gathering these documents, you’ll be taking the first step toward successfully securing a construction loan. Ensure your documents are organized and ready to present, which can significantly enhance your chances of getting approved.

Determining The Right Loan Amount For Your Needs

When considering a construction loan, one of the critical steps is determining the right loan amount for your needs. This process involves several factors that will help you arrive at an amount that is not only feasible but also sustainable in the long run.

First, assess the total cost of your construction project. This includes not just the raw construction costs, but also permits, fees, and any additional expenses that can add up. Creating a detailed estimate will ensure you have a clear understanding of the overall financial requirements before proceeding.

Second, consider your how to balance your personal finances with the loan amount. It’s essential to evaluate your existing debts and monthly expenses to ensure that you won’t be overextending yourself. A common rule of thumb is that your total monthly housing payment should not exceed 28% of your gross monthly income.

Additionally, it’s wise to account for unexpected costs. Construction projects often encounter unforeseen expenses, so having a contingency fund of 10-20% above your estimated costs can provide a safety net.

Communicate with potential lenders to discuss options tailored to your situation. They can provide insights on what loan amounts are typical for projects similar to yours, as well as help you understand any limits related to your credit profile and financial standing.

By carefully evaluating these aspects, you’ll be better equipped to determine the right loan amount that aligns with your project goals and financial health.

How To Choose The Best Lender For A Construction Loan

Selecting the right lender for your construction loan can significantly impact the success of your project. Here are some key factors to consider while determining how to choose the best lender:

- Research Lender Options: Start by investigating different lenders that specialize in construction loans. This can include traditional banks, credit unions, and online lenders.

- Compare Rates and Terms: Look for lenders that offer competitive interest rates and favorable terms. A lower rate can save you significant money in the long run.

- Understand Loan Types: Familiarize yourself with the different types of construction loans available. This will help you identify which loan product aligns best with your project needs.

- Check Lender Reviews: Read customer reviews and ratings to gauge the lender’s reputation. Positive feedback from previous borrowers can indicate reliability and quality service.

- Assess Your Financial Situation: Before finalizing a lender, ensure that your financial profile matches their lending criteria. Some lenders may have more stringent requirements than others.

- Consider Customer Service: A lender who provides excellent customer service can make the loan process smoother. Assess how responsive and helpful they are during your initial inquiries.

- Ask About Fees: In addition to interest rates, inquire about any additional fees associated with the loan. Understanding the full cost of borrowing will help you make a more informed decision.

- Consult Professionals: If you’re feeling overwhelmed, consider consulting a financial advisor or a mortgage broker who can guide you through the process and help you find the best lender.

By carefully evaluating these aspects, you’ll be well-equipped to how to choose the best lender for your construction loan, setting a strong foundation for your project’s financial success.

Frequently Asked Questions

What are the first steps to take when preparing for a construction loan?

Start by assessing your financial situation, checking your credit score, and determining your budget for the project.

How important is a credit score for securing a construction loan?

A good credit score is crucial as it influences your loan terms, interest rate, and lenders’ willingness to finance your project.

What documents are typically required to apply for a construction loan?

You will usually need tax returns, bank statements, proof of income, details about the construction project, and any existing debt information.

Should I have a detailed construction plan before applying for the loan?

Yes, having a detailed construction plan helps lenders understand the scope of the project and its associated costs, making it easier to secure funding.

What is the difference between a construction loan and a traditional mortgage?

A construction loan is typically short-term and used to cover the costs of building a home, while a traditional mortgage is long-term financing for an already built property.

What should I consider when estimating the costs of my construction project?

Consider materials, labor, permits, and potential overruns. It’s also wise to include a contingency fund for unexpected expenses.

Can I use a construction loan for renovations or is it only for new builds?

You can use a construction loan for both new builds and significant renovations, as long as the project meets the lender’s requirements.

Leave a Reply