In the ever-evolving landscape of home financing, navigating current construction loan rates can be a daunting task for homeowners. With numerous factors influencing these rates, it’s crucial to stay informed to make well-rounded financial decisions.

This article provides expert insights tailored for homeowners looking to understand the intricacies of construction loan rates, from how they impact your overall budget to strategic approaches for securing favorable terms.

As we delve into the current market trends and future predictions, you’ll gain valuable knowledge to empower your home-building journey. Whether you’re embarking on a new project or refinancing an existing loan, these insights will help you navigate the financial landscape with confidence and clarity.

Understanding Current Construction Loan Rates for Homeowners

When it comes to financing a new home or renovation, understanding current construction loan rates is crucial for homeowners. Unlike traditional mortgages, construction loans are short-term, typically lasting between 6 months to 1 year, and are designed to fund the building process. The rates you encounter can significantly impact your overall project budget and financing options.

Current construction loan rates vary based on several factors, including the type of loan (fixed or variable), the lender’s criteria, and prevailing market conditions. Generally, these rates can be higher than traditional mortgage rates because of the increased risk associated with construction projects.

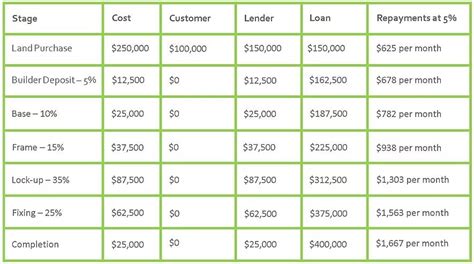

Homeowners should be aware that these loans are often disbursed in stages as the construction progresses, which means the interest is paid on the amount drawn rather than the total loan amount. Consequently, understanding how interest accrues during different phases and the implications of your rate choice can help in efficient budgeting throughout the construction process.

It is also important to compare different lenders’ offers in order to secure the best option available, as rates can differ significantly. Engaging with financial advisors or professionals is advisable to navigate the complexities of current construction loan rates and to make informed decisions that align with your financial objectives.

Factors Influencing Current Construction Loan Rates

Understanding the current construction loan rates can help homeowners make informed financial decisions. Several factors contribute to the fluctuation of these rates, and recognizing them is crucial for anyone looking to secure a construction loan.

- Economic Conditions: The overall state of the economy plays a significant role in determining loan rates. In times of economic growth, rates may rise due to increased demand for loans, whereas during a recession, rates might decrease to encourage borrowing.

- Interest Rate Trends: The central bank’s policy on interest rates directly impacts current construction loan rates. When the Federal Reserve adjusts its rates, lenders respond accordingly, affecting the cost of borrowing.

- Credit Scores: A borrower’s credit score is a key determinant of the rate they may receive. Higher credit scores typically secure lower rates as lenders perceive less risk.

- Loan-to-Value Ratio (LTV): The LTV ratio, which compares the amount borrowed to the appraised value of the property, can influence loan rates. A lower LTV results in more favorable rates, as lenders generally view these loans as less risky.

- Loan Type: Different types of construction loans, such as fixed-rate or variable-rate loans, can also impact the rates. Understanding the nuances of each loan type can help homeowners choose the best option for their needs.

- Location and Property Type: The location of the property and its type can affect the rate. For instance, construction projects in high-demand areas may command higher rates due to perceived value and risk.

By staying informed about these factors, homeowners can better navigate the landscape of current construction loan rates and potentially secure more favorable terms for their projects.

How Current Construction Loan Rates Affect Your Budget

The current construction loan rates can have a significant impact on homeowners’ budgets. Understanding how these rates play out in your project’s overall financial plan is essential to managing costs effectively. Here are several ways these rates can influence your financial planning:

- Monthly Payments: Higher current construction loan rates result in increased monthly payments. When rates rise, it means that more of your budget will be allocated to loan repayments, which could limit funds available for labor, materials, or unexpected expenses.

- Loan Amount: The rate can also influence the total amount you can borrow. If the market has high rates, lenders may reduce the amount they are willing to lend, affecting your ability to finance the entire construction project.

- Interest Costs: Over time, even a small difference in interest rates can lead to a substantial increase in total interest costs for the life of the loan. This, in turn, can significantly affect the overall budget and financial trajectory of your construction project.

- Project Scope Adjustments: With fluctuating current construction loan rates, homeowners may need to reassess the scope of their construction projects. A rise in loan interest might necessitate scaling back plans to stay within budget constraints.

- Cash Flow Management: As construction progresses, managing cash flow effectively becomes crucial. Understanding how current construction loan rates affect cash flow can help ensure that there are enough funds to cover ongoing expenses, avoid delays, and potentially incur extra costs.

Being mindful of how current construction loan rates impact your overall budget is vital for effective financial planning. Homeowners should regularly monitor market trends and seek advice to make informed decisions that align with their budgetary constraints.

Strategies to Secure Favorable Current Construction Loan Rates

Securing favorable Current Construction loan rates is essential for homeowners looking to build their dream home without exceeding their budget. Here are some effective strategies to consider:

- Improve Your Credit Score: A higher credit score can significantly influence the interest rates offered by lenders. Review your credit report, pay down debts, and ensure timely bill payments to enhance your score.

- Shop Around: Don’t settle for the first lender you come across. Get quotes from multiple banks and credit unions to find the best Current Construction loan rates available. Consider using tools or platforms that allow you to compare different loan products.

- Consider Loan Types: Different types of construction loans may come with varying rates. Familiarize yourself with options such as fixed-rate loans, variable-rate loans, and hybrid loans to determine which aligns best with your financial situation.

- Make a Larger Down Payment: Offering a larger down payment can sometimes lead to lower interest rates. It reduces the lender’s risk and may qualify you for better terms.

- Lock in Your Rate: Once you find a favorable rate, consider locking it in to protect against fluctuations. Rate locks can vary in length, so discuss your options with your lender.

- Maintain a Solid Financial Profile: Lenders look favorably on applicants with stable employment and lower debt-to-income ratios. Ensure your financial profile demonstrates reliability to help secure better rates.

- Utilize a Mortgage Broker: A mortgage broker can help navigate the complexities of securing a Current Construction loan. They have access to various lenders and can work to find competitive rates that meet your needs.

By implementing these strategies, homeowners can enhance their chances of securing favorable Current Construction loan rates, ultimately leading to a more affordable and successful building experience.

The Future of Current Construction Loan Rates: Trends and Predictions

As the housing market continues to evolve, so too do current construction loan rates. Homeowners and builders must stay informed about the trends shaping these rates to make better financial decisions. Here are several key factors and predictions for the future of current construction loan rates:

- Economic Recovery: As the economy recovers from fluctuations, construction loan rates may stabilize. An increase in consumer confidence could lead to more construction projects, affecting demand for loans.

- Interest Rate Changes: Central banks, particularly the Federal Reserve, will influence interest rates through monetary policy. Future rate hikes or cuts may directly impact current construction loan rates.

- Supply Chain Dynamics: The ongoing issues in the supply chain and their resolution will play a significant role in construction costs. If supplies become more accessible and costs decrease, it could lead to lower loan rates.

- Government Policies: Legislation aimed at stimulating housing development, such as tax incentives or grants for builders, could also keep current construction loan rates more competitive.

- Technological Advancements: Innovations in construction technology may improve efficiency and reduce costs, with potential ramifications on financial rates.

While it’s difficult to predict with certainty how current construction loan rates will evolve, staying aware of these trends and factors can help homeowners and builders plan for future projects effectively. Being proactive and informed is key to navigating the ever-changing landscape of construction financing.

Frequently Asked Questions

What are current construction loan rates?

Current construction loan rates typically vary based on market conditions, lender policies, and borrower qualifications, but they generally range from 3% to 6% as of late 2023.

How do construction loan rates compare to traditional mortgage rates?

Construction loan rates are usually higher than traditional mortgage rates due to the increased risk associated with financing the building process.

What factors influence construction loan rates?

Factors that influence construction loan rates include the borrower’s credit score, the loan amount, the type of construction (new build vs. renovation), and economic indicators like inflation and interest rates.

Are there different types of construction loans available?

Yes, there are several types of construction loans, including construction-to-permanent loans, stand-alone construction loans, and renovation loans, each serving different financing needs.

What steps can homeowners take to secure a better construction loan rate?

Homeowners can secure better loan rates by improving their credit scores, shopping around for rates from multiple lenders, and making a larger down payment.

What is the typical duration for a construction loan?

Construction loans typically last from 6 to 12 months, depending on the project’s scope; they are often converted to permanent mortgages upon completion.

How can homeowners determine if a construction loan is right for them?

Homeowners should assess their financial situation, project costs, potential resale values, and their readiness for the complexities of construction before deciding on a construction loan.

Leave a Reply